Can the EU Hit 90% Emissions Cuts by 2040—And What Comes Next?

- Jul 9, 2025

- 3 min read

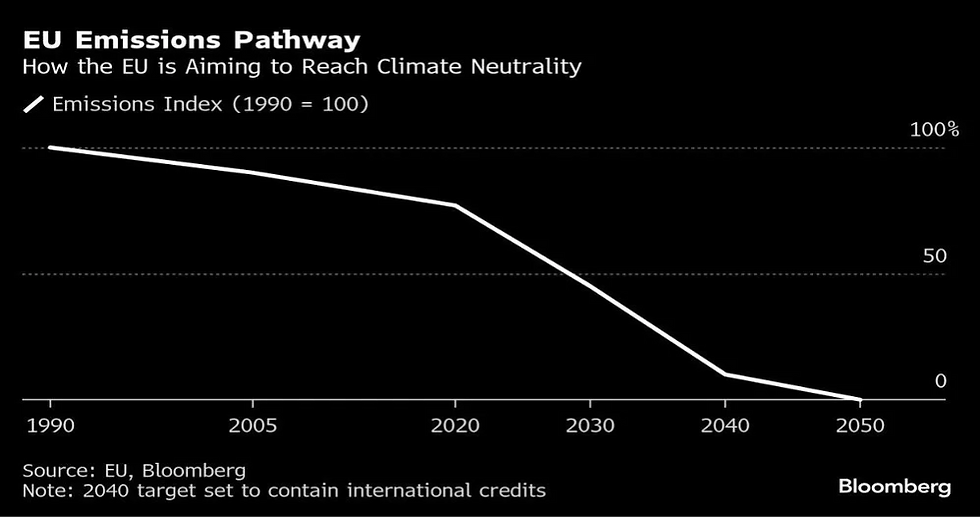

On July 2, 2025, the European Commission announced a proposal for a legally binding climate target: cutting net greenhouse gas emissions by 90% by 2040 compared to 1990 levels. This target, described by EU Climate Commissioner Wopke Hoekstra as “ambitious but achievable,” aims to accelerate Europe’s shift toward a climate-resilient economy while maintaining energy security and competitiveness. However, the inclusion of flexible tools like international carbon credits and domestic removals has sparked debate over ambition and accountability. The proposal signals the start of a critical political and financial alignment phase ahead of the 2026 EU elections.

Why this Matters

If the EU delivers a 90% cut by 2040, it sets a global climate benchmark for ambition and accountability.

If the EU uses too many carbon offsets, it might slow down real progress in cutting pollution at home.

If the target drives early investment in renewables, clean hydrogen, and electrification, Europe can lead the global green economy.

Scenario: If a delivery company switches its fleet to electric vehicles early, then it can reduce fuel costs, meet climate rules faster, and gain a reputation as a clean brand.

Net-zero alignment is increasingly embedded in EU green taxonomy, CSRD, and investor frameworks. This target accelerates that integration.

What is the 2040 Climate Target?

The European Commissions is calling for a net 90% reduction in greenhouse gas emissions by 2040, compared to 1990 levels. This builds on the EU’s existing goal of reaching net-zero emissions by 2050 and cutting 55% by 2030.

Up to 3% of the target can be achieved through international carbon credits (purchased from other countries).

Domestic removals can count toward the goal.

Member states will retain some discretion over how to structure and implement national climate plans.

Why is There Controversy Over Flexibility?

Climate advocacy groups, scientists, and some policy experts argue that too much reliance on offsets and removals weakens the integrity of the EU’s climate plan. Moreover, critics worry this will:

Allow polluting sectors to delay real cuts

Create loopholes for “carbon laundering” through unverified or low-quality credits

Shift the burden of emissions reduction to lower-income countries supplying offsets

For example, if the EU reaches its 90% target with 3% foreign credits and significant domestic offsets, the actual domestic emissions cuts may fall below 85%, putting the region at risk of missing the standards of the Paris Agreement.

How Could This Affect Corporate Action?

The 2040 target is more than a symbolic step—it reshapes how businesses, investors and financial institutions must think about risk and transition.

Investors will need to pressure companies to align long-term strategies with the 2040 target, not just 2030. Expect more scrutiny on “transition plans” under CSRD and ISSB guidance.

Firms in heavy-emitting sectors, especially energy, transportation, and manufacturing, will face increasing pressure to electrify or integrate carbon capture.

Innovation in resilience and adaptation will gain urgency as emissions reductions intersect with physical climate risks.

The Key Shift: The EU is no longer just incentivizing clean energy—it’s operationalizing its carbon budget.

Challenges and Considerations

This target must pass both the European Parliament and Council. Several nations, including Poland and Italy, have expressed concerns about fairness, costs, and industrial competitiveness.

Wealthier countries may adopt the target quickly, but others may require funding mechanisms and support to comply.

The EU aims to model leadership, but without similar commitments from the U.S., China, and major emitters, the global climate budget remains under threat.

Accelerate Your Climate Strategy: Action Items

To align with the EU’s 2040 target and attract future-focused investment, companies and investors can:

Update Transition Plans: Adjust your long-term decarbonization strategy to reflect the EU’s new 90% emissions reduction goal.

Prioritize Real Emission Cuts: Invest in direct emissions reductions before turning to offsets, to meet rising expectations around credibility.

Enhance Climate Reporting: Use frameworks like CSRD, ISSB, and the EU Taxonomy to clearly communicate emissions pathways and progress.

Engage in Climate-Aligned Innovation: Focus on clean energy, electrification, and low-carbon technologies that support long-term EU climate targets.

Companies across sectors—energy, transport, real estate, and heavy industry—can take advantage of this policy shift by acting early. Those that lead on credible reductions and transparent reporting will be better positioned to meet investor expectations, secure financing, and manage long-term climate risk.

The EU’s 2040 climate target is bold—and contentious. If paired with strong regulation, high-integrity credits, and domestic decarbonization, it could accelerate the green economy and build global momentum toward COP30. But without vigilance, it risks becoming a loophole-ridden framework that delays real change. Now is the moment to ensure that 90% means action—not accounting.

Comments