On the Street …The Heat Is On

- 22. Juli 2022

- 2 Min. Lesezeit

July 23, 2022

This year and going forward, companies will face increasing pressure to begin their active transition to a low-carbon, sustainable, and equitable future, pushed by many factors, including last year’s momentous COP-26 climate summit. But overall, companies net-zero commitments globally in aggregate fall well short of needed transition by 2050 to achieve IEA’s Net Zero by 2050.

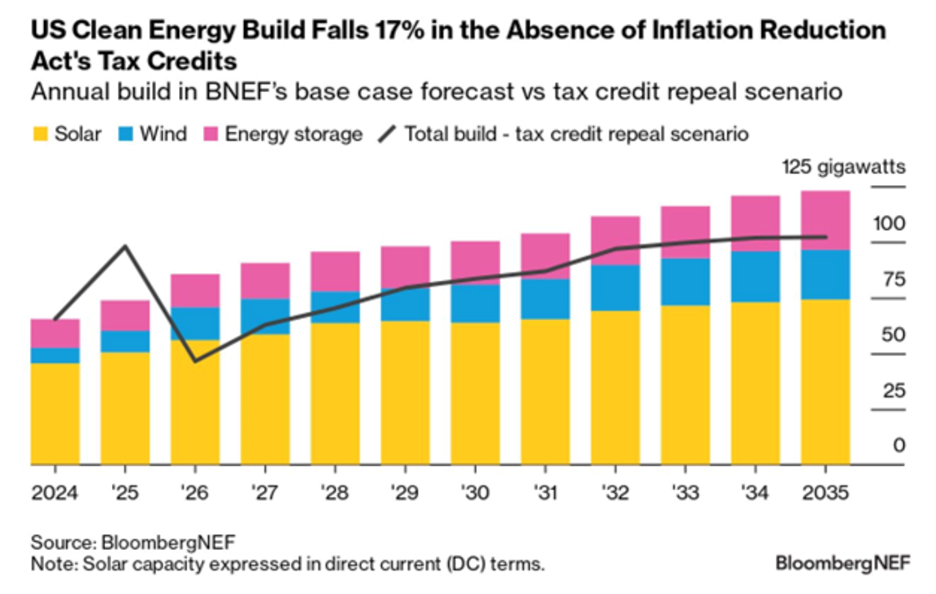

Russia's invasion of Ukraine and surging energy prices could boost demand for wind and solar power as lawmakers seek options to curb Russian energy import. If Europe directs 300 billion euros to wind and solar over 2022-25, power-sector gas use could be virtually eliminated.

Fixed income

Bloomberg reported that as green lending is expanding, green loans could be 55% of China’s total lending in ten years, by 2032.

Global, European and U.S. ESG-weighted corporate bond indexes beat non-ESG benchmarks with similar risk characteristics through June, despite the rise in Treasury yields and inflation, as incorporating ESG considerations has become a beneficial factor during periods of market stress and rising interest rates.

Equities

U.S. ESG performance though 2022 could be hurt as technology (overweight in many funds) faces a dim outlook on interest-rate risk and the Russia-Ukraine conflict.

Commodities and Derivatives

In what looks like a positive sign for wind and solar demand, higher carbon prices are raising coal and natural gas power plants' operating costs, making renewables look cheaper.

Markets, Fiscal, and Monetary Policy

Fed may raise rates again at its next meeting with 50 basis-point move most likely on the table when policy makers gather July 26-27. This could positively impact longer-term ESG investors as markets exit an artificial construct that where rates were too low resulting in unreasonable valuations and price and fundamental distortions that overly favored non-climate aligned strategies and corporations. As rates normalize with the return of the traditional use of U.S. government debt as a risk mitigant, the pathways forward favor a more sustainable destination, that path towards the destination will continue along its bumpy ride.

ESG assets surpassed $35 trillion in 2020 and are now a third of the total assets, according to the Global Sustainable Investment Association. Assuming 15% growth, ESG assets may exceed $41 trillion by 2022 and $50 trillion by 2025

ESG Integration™ strategies are growing as investors seek to be informed by and influence corporate strategy discussions and outcomes to influence ESG investment thesis that support a transition to a low-carbon, sustainable, and equitable future. But flows into ESG ETFs fell to $24.7 million in 1Q, half the amount in the same quarter in 2021. At the same time, continued downward pressure on expense ratios are pushing active managers towards ETFs with expense ratios hovering around 0.33% (33 basis points). This makes it more difficult for funds to gather assets that are more complicated ESG investing strategies that are trying to address complex real-world concerns.

Responsible Alpha song that tells it all, what we are listening to is or better regulation, as rebranding increases greenwashing risks and dTilutes ESG.

The Responsible Alpha song that tells it all, what we are listening to is The Heat Is On by Glen Frey.

Kommentare