Japan’s Green Nuclear Transformation: Transition Bonds Funding Opportunity

Key Recommendations

This paper offers three core implications for investors and financial institutions to consider:

-

Reassessing nuclear exposure as a transition finance opportunity, rather than a blanket ESG exclusion, particularly for long-duration fixed-income portfolios.

-

Prioritizing policy credibility and regulatory stability as core credit factors when pricing Japanese utility bonds, above traditional spread or yield considerations.

-

Strategically evaluating USD-denominated green and transition bonds as vehicles for accessing Japan’s Green Transformation (GX)-driven energy transition, while actively managing currency and refinancing risks.

Japan’s Energy Transition and the Urgent case for Financing

Japan now stands at a historic inflection point in its energy transition. According to the Green Transformation (GX) Basic Policy released by the Ministry of Economy, Trade and Industry (METI) in 2023, Japan has set two main goals: achieving carbon neutrality by 2050 and revitalizing industry, which includes strengthening energy security. Heavy reliance on imported fossil fuels (e.g., LNG) has become a national security vulnerability resulting in diversification into nuclear power and Japan's national energy strategy.

Japan’s refreshed Nationally Determined Contribution (NDC) published in February 2025 set ambitious goals to reduce greenhouse gas emissions by 60% by fiscal year 2035 and by 73% by fiscal year 2040 compared to FY2013 levels. These targets align with the global 1.5 °C objective and put the country on a direct path toward achieving net-zero emissions by 2050. These enhanced commitments underscore the urgency of expanding low-carbon energy sources, including nuclear power, to meet both climate and energy-security objectives.

The GX framework commits more than ¥150 trillion (approx. $1 trillion) in public-private investment over the next decade. It is supported by new financing mechanisms (see Appendix A) such as GX Transition Bonds and growth-oriented carbon pricing*, to mobilize capital for low-carbon power and industrial upgrades. The long-term investment roadmap for the GX strategy will utilize nuclear power to ensure a stable electricity supply to achieve net-zero emissions. Priority will be given by the national government to restart nuclear reactors that pass safety reviews (METI, 2023).

Japan’s carbon-pricing framework functions as a two-pillar system integrating a carbon levy and an emissions-trading scheme (ETS) (METI, 2023). The GX Emissions Trading Scheme (GX-ETS) began with a voluntary phase through the GX League in 2023, will become mandatory in FY 2026, and is expected to introduce allowance auctions for power generators by FY 2033. In parallel, a carbon levy will be introduced from FY 2028 on fossil-fuel importers and suppliers, starting at a moderate rate and rising progressively to balance industrial competitiveness with climate ambition. Together, these tools form the core of Japan’s “growth-oriented” approach—using market incentives rather than fixed caps to drive investment.

According to the latest Organisation for Economic Co-operation and Development (OECD) (2023) Carbon Pricing in Japan report, Japan’s average explicit carbon price across existing instruments is approximately €1.65 per mtCO₂e (≈ ¥300 ≈ $2.00), while the average net effective carbon rate (ECR)—which includes energy and fuel excise taxes—reaches roughly €3.32 per mtCO₂e (≈ ¥600 ≈ $4.00). These values remain among the lowest in the OECD, underscoring the limited fiscal weight of carbon pricing in Japan’s current policy mix. Nonetheless, revenues generated under this evolving framework are earmarked to fund GX Transition Bond repayments and to subsidize industrial decarbonization projects.

Taken together, these policy commitments create not only an energy-transition challenge but a clear financing urgency. Japan expects to raise ¥20 trillion (approx. $130 billion) through GX Transition Bonds over the next decade, underscoring the scale of the funding gap that must be filled to support nuclear restarts and broader decarbonization efforts (JapanGov, 2024).

Post-Fukushima Structural Shock to the Power System

After the Fukushima Daiichi nuclear disaster in March 2011, Japan’s nuclear-fleet operations collapsed (which means every single nuclear reactor in Japan was shuttered): out of 54 commercial reactors prior to the accident, only 10 (≈9.5 GW capacity) had been restarted by mid-2023 (World Nuclear Association, 2023). As a consequence, thermal-fired generation (gas + oil) surged: for example, according to the 2012 report of the U.S. Energy Information Administration, in the first four months of 2012, thermal generation rose to nearly 90% of total electricity output compared to about 64% in the same period in 2011. At the same time, LNG imports by power utilities increased by around 34% year-on-year in early 2012 (first four months) to compensate for lost nuclear generation.

Figure 2: Monthly Average Generation by Electric Utilities in Japan, By Source, January 2007-April 2012. Source: U.S. Energy Information Administration.

Figure 3: Fuel Consumption for Power Generation in Japan, January 2007-April 2012. Source: U.S. Energy Information Administration.

Since 2023, responding to volatile global energy prices and geopolitical dynamics, Japan has accelerated safe nuclear restarts and placed greater emphasis on next-generation reactor technologies: by 2024, utilities had restarted at least 14 reactors since the Fukushima accident (Financial Times, 2025). For example, the restart of Onagawa Nuclear Power Plant Unit 2 (825 MW) in late 2024 marked the first time a reactor of the same type as Fukushima Daiichi returned to operation, with operators citing large fuel‐cost savings and reduced LNG dependence (Reuters, 2024).

Nuclear Restarts, Capital Intensity, and the USD Green Bond Inflection

While policy momentum has clearly shifted toward nuclear rehabilitation, the financial reality confronting utilities remains highly constrained. Restarting idle nuclear units requires substantial capital outlays to retrofit post-Fukushima safety systems, reinforce seismic protections, and reconfigure generation portfolios. These investment needs frequently exceed what utilities can finance through internal free cash flow, particularly in firms that remain heavily reliant on thermal power generation (Hokkaido Electric Power Company, 2025).

In 2025, Hokkaido Electric Power (HOKKEL) became the first Japanese electric utility to issue a U.S. dollar, denominated green bond in the international market, establishing a new benchmark for nuclear-linked sustainable finance. The company issued a $500 million green bond to support restart-related investments at the Tomari Nuclear Power Station. The transaction attracted exceptionally strong investor interest, generating an order book of approximately $6 billion, reflecting substantial global demand for labeled green and transition instruments (Choy, 2025).

Beyond the transaction itself, this issuance represented a strategic inflection point: it demonstrated that nuclear restart projects could be absorbed into global sustainable-finance markets, opening a scalable pathway for other Japanese utilities to access international ESG-aligned capital.

Nuclear Assets and Balance-Sheet Exposure of Japanese Utilities

According to Bloomberg data as of September 2025, Japan’s publicly listed regional power utilities collectively operate 51 commercial nuclear units, of which nine are currently active, 20 are suspended for inspection, and 16 are under decommissioning. Nuclear capacity remains concentrated among a handful of major utilities:

-

Kansai Electric Power (KEPCO) — 11 units at Mihama, Ohi, and Takahama, with six currently operating.

-

Kyushu Electric (KYUDEN) — 4 units at Genkai, with one in operation.

-

Tokyo Electric Power (TEPCO) — 17 units, but most remain suspended or under decommissioning.

-

Hokkaido, Hokuriku, and Shikoku Electric — each owning 2–3 reactors, all currently idle or awaiting restart.

From a financial standpoint, these utilities are significantly leveraged, further making the case for the urgent need to fund Japan’s nuclear power ambitions as a transition enabler. Bloomberg data indicates outstanding senior unsecured debt of approximately:

-

$1.89 billion for TEPCO.

-

$1.08 billion for KEPCO.

-

$991 million for Hokkaido Electric.

-

$735 million for Kyushu Electric.

-

$621 million for Chubu Electric.

Table 1: Data compiled Responsible Alpha from Bloomberg Terminal (Appendix B).

Most issuances are yen-denominated corporate bonds, but a growing number, including those by Kyushu Electric and Hokkaido Electric, feature green or transition labels, with some USD tranches aimed at international investors (see Appendix B). This reflects an emerging strategic pivot toward sustainable finance to fund nuclear restarts, safety retrofits, and decarbonization projects.

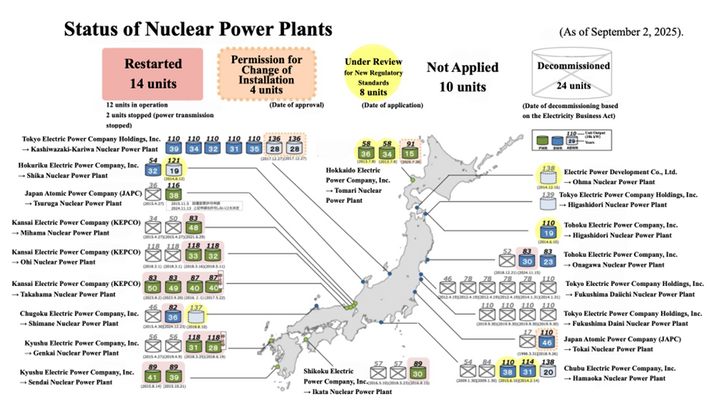

While official METI data (2025) report a national total of 60 commercial reactors (14 restarted, 4 approved for modification, 8 under review, 10 unsubmitted, and 24 decommissioned), the Bloomberg dataset only includes listed utilities with tradable equity tickers, excluding state-owned or non-listed entities such as the Japan Atomic Power Company (JAPC).

Figure 4: Current Status of Nuclear Power Plants in Japan. Source: METI, 2025

Therefore, the numerical gap between METI’s 60 and Bloomberg’s 51 units reflects different reporting scopes, not inconsistency. Together, these two datasets form a complementary picture: METI describes the regulatory and national status, while Bloomberg highlights corporate-level operational and financing structures critical to Japan’s energy transition.

The Rise of USD Green and Transition Bonds

According to Bloomberg data, Japan’s major regional utilities have issued approximately USD 3,023 million in green labeled bonds (see Appendix C), the majority of which are yen-denominated corporate bonds. Tokyo Electric Power (TEPCO), Kansai Electric Power (KANSEL), and Hokkaido Electric (HOKKEL) account for a substantial share of these issuances, reflecting a historical reliance on a domestic investor base. However, since 2024, several utilities have begun tapping into the U.S. dollar bond market to diversify funding sources and attract international ESG investors.

A milestone in this shift was set by Hokkaido Electric Power (HOKKEL), which in August 2025 issued a $500 million green bond, the first U.S. dollar green issuance by a Japanese electric utility. The bond, rated BBB+ and maturing in 2030, priced at a coupon of 4.587%, drawing more than $6 billion in orders from global investors. Proceeds are allocated to the safety upgrades and restart of the Tomari Nuclear Power Station, which is expected to replace up to 80% of the company’s thermal generation capacity by 2030, substantially reducing both fuel costs and carbon emissions (Choy, 2025).

Compared with yen bonds, such as KANSEL’s 2030 A3-rated green bonds (around 1.9% to 2.1%) and KYUSEL’s 2029 issues (around 1.7% to 2.0%) (see Appendix A), HOKKEL’s USD bond offers a higher yield and longer maturity, compensating investors for both currency and credit risks. Yet the strong demand suggests growing acceptance of nuclear-related green financing among international investors. This shift represents not simply financial diversification, but a structural re-embedding of nuclear power into global sustainable-finance frameworks.

Overall, the rise of USD green and transition bonds marks a turning point in Japan’s energy finance landscape. As the Green Transformation (GX) policy targets more than ¥150 trillion (approx. $1 trillion) in public–private investment over the next decade, utilities will increasingly rely on overseas capital to fund nuclear restarts and low-carbon upgrades. This evolution signals a broader trend: Japanese utilities are moving from domestic debt markets toward global sustainable finance, with nuclear power gradually being reclassified—not as a legacy risk, but as a legitimate component of the clean energy transition.

Risks, Regulatory Fragility and Financing Sustainability

Several risks could constrain this momentum. Policy uncertainty remains the most immediate concern: changes in government priorities or delays in nuclear restarts could undermine both funding continuity and investor confidence. Taxonomy and perception risks also persist, as global ESG standards are divided on whether nuclear power qualifies as “green.” This inconsistency may limit cross-border investment and restrict the participation of certain institutional funds.

On the financial side, currency and interest rate volatility increase the risk of borrowing costs for utilities already burdened with high leverage. For smaller regional utilities, exposure to USD debt could create refinancing pressure if market conditions tighten. At the same time, execution risk, the ability to deliver safe restarts and achieve emission targets will determine the credibility of these transition instruments.

Conclusion

Japan’s shift toward green and transition bonds, especially in the U.S. dollar market, marks a practical step in funding its low-carbon transition focused on nuclear energy. These instruments broaden Utility companies access to international capital while reinforcing the financial foundation for the Green Transformation (GX) agenda. The success of HOKKEL’s 2025 USD green bond shows that investors are willing to support nuclear-linked projects when they are transparent, measurable, and clearly aligned with climate goals.

The central challenge is no longer whether capital is available, but whether institutional credibility and regulatory stability can be maintained.

Japan’s energy financing strategy is entering a more disciplined and internationally visible stage, setting a precedent for sovereign transition bonds. The key challenge is no longer issuance volume but maintaining policy stability and proving genuine environmental outcomes while managing currency and refinancing risks. If managed well, green and transition bonds can evolve from a temporary funding tool into a robust mechanism for Japan’s decarbonization and energy security, positioning the country as a credible regional leader in sustainable finance.

Appendix A. Key Financing Mechanisms under Japan’s Green Transformation (GX) Framework

Japan’s Green Transformation (GX) Basic Policy establishes a comprehensive investment and financing system to mobilize more than ¥150 trillion (≈ $1 trillion) of public-private capital over the next decade.

The framework combines sovereign financing, carbon-pricing revenue recycling, and market-based instruments to accelerate decarbonization while maintaining energy security and industrial competitiveness.

The four core mechanisms are summarized below.

GX Transition Bonds (GX Transition / Climate Transition Bonds)

The Government of Japan issues Japan Climate Transition Bonds (also called “GX Economic Transition Bonds”) to raise advance investment funds. According to the Ministry of Finance: “Japan will issue approximately ¥20 trillion (≈ $130 billion) in transition bonds to promote GX.”

The bond issuance allows the government to mobilize capital in advance for industrial decarbonization, low-carbon energy, hydrogen, and ammonia value chains, and CCUS technology upgrades.

The bond redemption is linked to future carbon-pricing revenues: the government explicitly states in its framework that the bonds will be supported by fiscal resources generated from the introduction of carbon pricing (Ministry of Finance Japan. (2025). Japan Climate Transition Bonds Framework).

Growth-Oriented Carbon Pricing Scheme

According to the GX Basic Policy, Japan proposes a “growth-oriented carbon-pricing” concept aimed at promoting both economic growth and emissions reduction.

The system includes three main policy tools (METI, 2023):

-

National bond financing support (mobilizing capital through the GX Transition Bonds).

-

Emissions Trading System (GX-ETS): Japan has launched GX-ETS as a national emissions-trading framework, voluntary at first and planned to become mandatory later.

-

Carbon Levy / GX Surcharge: Scheduled to be implemented around FY 2028 on fossil-fuel import and supply stages.

Public-Private Blended Finance and Tax Incentives

Under the GX framework, the government promotes industrial transition to low-carbon models through blended finance (public funds guiding private investment), preferential loans, debt guarantees, and tax reductions.

For example, the government states (METI, 2023, Basic policy for the realization of GX (Green Transformation, and GR Japan, 2023, Overview of Japan’s Green Transformation (GX) plans.)

“We will increase the added value of GX-related products and enterprises through carbon-pricing mechanisms.”

Although the full details of tax incentives have not been disclosed, this mechanism is clearly defined as part of the “new financing methods.”

Transition Finance and Private-Sector Green / Transition Bonds

The Japanese government and related institutions encourage industries to issue labeled “transition bonds” or green bonds to provide financing for key sectors—such as steel, chemicals, and power generation—that are difficult to decarbonize quickly.

Reports indicate that by 2024, Japan’s cumulative issuance of transition bonds accounted for a significant share (70%) of the global market (Nomura Connects. (2024). Japan Pioneered Transition Bonds but Needs Demand to Grow the Market).

Appendix B: Japanese Electric Utilities Debt Outstanding

Table 2: Japanese Electric Utilities Debt Outstanding (September 2025). Source: Bloomberg, L.P.